Foreign Remittances and Exchange Rate Fluctuations as Economic Threats to Stock Market Stability in South Asian Countries: The Moderating Role of Political Stability

DOI:

https://doi.org/10.71146/kjmr559Keywords:

Foreign Remittance, Exchange Rate, Stock Market Performance, Political Stability, Global Oil Price, South Asian CountriesAbstract

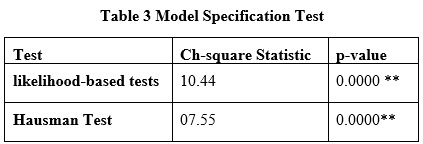

This study investigates the impact of key macroeconomic and institutional factors, including global oil prices, foreign remittances, exchange rates, and the interaction between foreign remittances and political stability on stock market performance in South Asian economies from 2005 to 2023. Utilizing a fixed effect model on panel data, the results reveal that global oil prices, foreign remittances, and exchange rates each have a positive and statistically significant effect on stock market performance, highlighting their crucial role in driving financial market behavior. Moreover, the interaction term between foreign remittances and political stability is also significant, suggesting that remittances exert a stronger influence on stock markets in politically stable environments. The model demonstrates a high explanatory power with an R-squared value of 0.91, indicating the robustness of the selected variables. These findings underscore the importance of macroeconomic stability, institutional strength, and governance in enhancing stock market performance. The study offers actionable policy insights, recommending the promotion of formal remittance channels, maintenance of exchange rate stability, effective utilization of oil revenues, and strengthening of political institutions to support sustained financial market growth.

Downloads

Downloads

Published

Issue

Section

License

Copyright (c) 2025 Muhammad Nasir Jamal, Sana Asghar, Umm-e-Hani, Muhammad Aftab Rafique, Asif Khan (Author)

This work is licensed under a Creative Commons Attribution 4.0 International License.