FISCAL DISCIPLINE IN PAKISTAN: A COMPARATIVE ANALYSIS OF IMPORT TAXES AT A FIXED EXCHANGE RATE FROM 2015 TO 2023.

DOI:

https://doi.org/10.71146/kjmr561Keywords:

Devaluation, Tax Collection, Exchange Rate, Customs Duty Collection JEL Classification, F31 (Devaluation, Exchange Rate), H26 (Tax Collection, Customs Duty Collection)Abstract

Aims

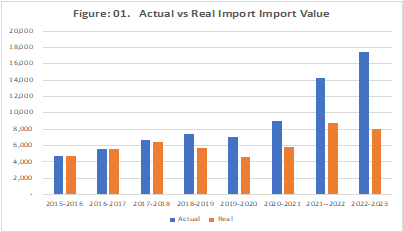

This study investigates the fiscal discipline in Pakistan by analyzing the performance of import taxes, particularly customs duties, from 2015 to 2023. It aims to evaluate the real growth in customs duty collection by adjusting for exchange rate fluctuations, using 2015 as the base year.

Method

A quantitative approach was employed. The study uses secondary data on customs duty collections and exchange rate movements over the period 2015–2023. By recalculating the customs duty in real terms using the 2015 exchange rate as a constant, the study compares the nominal versus real growth of import tax revenues.

Result

The findings reveal that reported customs duty collections are significantly overstated during periods of exchange rate devaluation. The analysis shows that the percentage difference between reported and real customs duty collections becomes substantial when nominal figures are not adjusted for currency depreciation.

Conclusion

The study concludes that assessing the performance of import tax collection in Pakistan solely based on nominal figures can be misleading. It recommends that policymakers and customs authorities evaluate tax collection performance using real terms adjusted for exchange rate fluctuations to ensure accurate fiscal assessment and planning.

Downloads

Downloads

Published

Issue

Section

License

Copyright (c) 2025 Dr. Afzal Mahmood, Ms. Rahila Hafiz, Ms. Ra’ana Nasee (Author)

This work is licensed under a Creative Commons Attribution 4.0 International License.