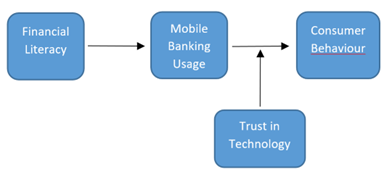

THE MODERATING ROLE OF TECHNOLOGY TRUST: EXAMINING HOW FINANCIAL LITERACY SHAPES MOBILE BANKING ADOPTION AND CONSUMER BEHAVIOR IN PAKISTAN

DOI:

https://doi.org/10.71146/kjmr516Keywords:

Financial Literacy, Mobile Banking Usage, Trust in Technology, Consumer Behaviour, Quantitative Approach, SmartPLSAbstract

The aim of this study is to identify how financial literacy impact on mobile banking usage and consumer behavior in the banking sector of Pakistan, with trust in technology as a moderating variable. For data collection, only the users of ten most profitable banks of four cities of Pakistan like Lahore, Faisalabad, Rawalpindi, and Karachi were included in this study. Partial Least Square structural equation modelling (PLS-SEM) approach was used to analyze the data, using the SmartPLS 4.0 software. On the basis of study’s findings, financial literacy is a significant indicator of mobile banking usage, which in turn positively impacts on consumer behavior. Furthermore, trust in technology acts as a moderator in this study to strengthen the impact of mobile banking usage on consumer behavior. Policy implications suggest the need for targeted financial literacy programs, enhanced digital security, and user-centric mobile banking services. The study also outlines key limitations, including its cross-sectional design and sample constraints, and offers recommendations for future research, such as exploring additional moderating variables and employing longitudinal methods to better understand evolving consumer patterns in digital finance.

Downloads

Downloads

Published

Issue

Section

License

Copyright (c) 2025 Asif Khan, Khiza Sohail, Ali Abbas, Muhammad Nasir Jamal (Author)

This work is licensed under a Creative Commons Attribution 4.0 International License.