THE IMPACT OF INTEREST RATES ON MORTGAGE, LEASING DEMAND, HOUSE PRICES AND ARBITRAGE OPPORTUNITY: A CASE STUDY OF PAKISTAN

DOI:

https://doi.org/10.71146/kjmr357Keywords:

Interest Rates, Mortgage Rates, Leasing Demand, Property Prices, Arbitrage, Inflation, GDP Growth, Simple Linear Regression, SPSS, PAKISTANAbstract

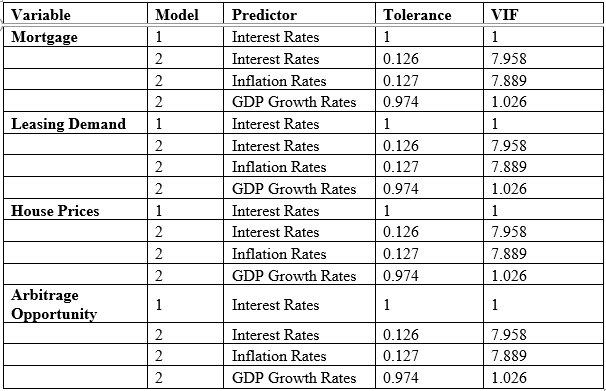

In this study, it is attempted to study how the interest rates have influence on key real estate market variables, including mortgage rates, leasing demand, house prices and arbitrage opportunities in Pakistan. The dataset used for the research is from 2014 to 2023 and the research employs a Simple Linear Regression (SLR) Model using SPSS software. The inclusion of inflation rates and GDP growth form controls variables to explain what drives the property sector more comprehensively.

The findings show that interest rates have a large positive effect on mortgage rates thus changes in monetary policy are directly reflected in borrowing cost. However, interest rates do not explain leasing demand or house prices very well, emphasizing that there are other significant factors influencing lease demand and home prices than interest rates. Also, the study explains how the interest rate has a negative impact on arbitrage opportunities against the prevailing financial theories that higher interest rates diminish the feasibility of the investment in real estate arbitrage.

The implications provided by these results are important for policymakers, investors, and financial institutions. However, mortgage markets are responsive to monetary policy while other policies may be needed to control prices of property and leasing trends. The findings also highlight the need for further research incorporating additional economic indicators, behavioural factors, and regional variations in Pakistan’s real estate market.

Downloads

Downloads

Published

Issue

Section

License

Copyright (c) 2025 NOMAN NAZIR, Dr. SOHAIB-UZ-ZAMAN, SYED HASNAIN ALAM (Author)

This work is licensed under a Creative Commons Attribution 4.0 International License.